Intelligent Execution. It’s What We Do.

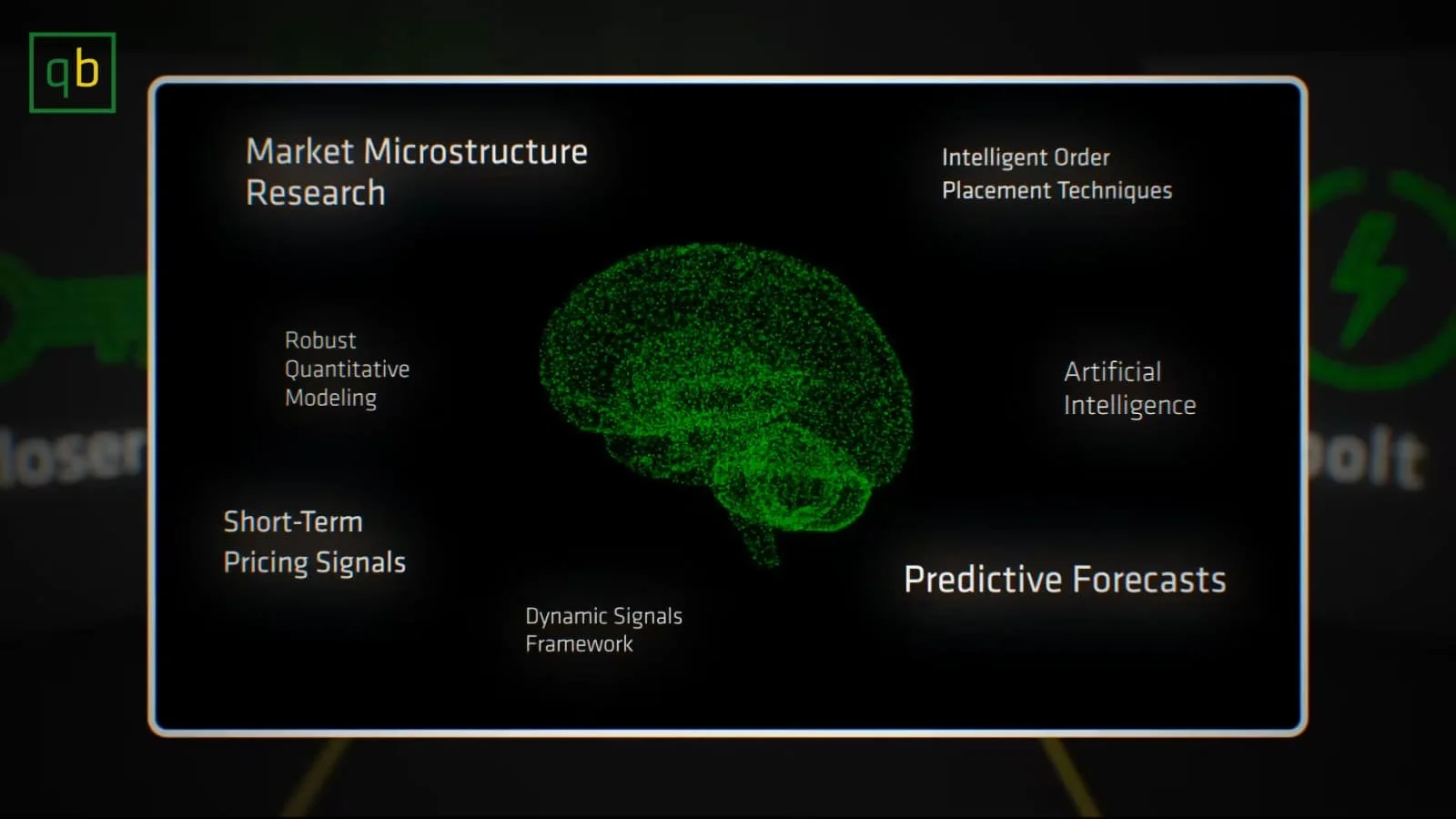

Quantitative Brokers’ goal is to be the world’s market leading provider of Quantitative Research driven Execution Algorithms for Listed and OTC financial instruments.

We quantifiably help our clients by providing research-driven trading solutions to reduce transaction costs, trade complex structures, measure execution performance and improve workflow efficiencies.